Automatic Crypto Investing

**Personal customization, exclusive strategy.

**Intelligent calculation, one in a billion.

**No configuration required, easy to use.

play video

Telegram

Join the RDABot authorized strategy education institute

RDABot Uses Supercomputers And AI Algorithms To Calculate Massive Strategies

While quantitative investing has dominated the financial world for decades, it is time for a more modern approach to quantitative finance. We combined traditional statistical and quantitative methods with the findings of leading machine learning research to develop systems with numerous advantages, including solid pillars of statistical wisdom and adaptability.

Why Choose RDABot

With powerful artificial intelligence neural network and high-end enterprise performance server, RDABot team uses technical analysis, social network sentiment analysis, fundamental analysis and more, as well as working through complex data types to find any scientific method that can be profitable.

Easy to Use

One click to run strategy without any settings

No Experience Required

Professional guidance enables you to quickly get started

Unique and Professional

All strategies are customized and private, equipped with professional strategy teaching

Secure and Transparency

RDABot has no access to your funds. All our operations are transparent and visible

Save Time and Emotions

Algo trading system relieves you from trading decisions and stress, and works 24/7

One-on-one Service

One-on-one service to quickly solve your problem

Our Strengths And Characteristics

Multidimensional data filtering yields the most effective automated trading strategy indicators.

We have screened nearly 40 sets of data for a comprehensive assessment of the quality of a strategy, conducting in-depth analysis on more than 200 market data points.

Random forests are used to evaluate the importance of features. The random forest model can generate an importance score for each feature. The importance (Importance_i) of a feature is usually measured by the mean decrease in impurity (Mean Decrease in Impurity, MDI) in the decision tree nodes. For each feature i: Importance_i = Σ (MDI of feature i in all trees) / number of trees

How to validate millions of trading models and derive the optimal strategy.

By applying data-driven methods and artificial intelligence techniques to quantitative trading, this process achieves more accurate and reliable trading decisions. Through large-scale data processing and model training, it is possible to discover and exploit subtle trends and trading signals in the market, thereby achieving higher levels of profitability and risk control capabilities.

Use machine learning to construct an infinite number of strategies, avoiding BOT being targeted by market depth.

By using linear regression, support vector machines, random forests, nearest neighbor algorithms, neural networks, deep learning, reinforcement learning, and ensemble learning to construct an infinite number of strategies, and then filtering out the most effective strategies, allowing each user to use the same strategy at the same time, effectively reducing the impact of market depth and escaping potential market maker traps.In this example, we will compare various model types, including linear regression, support vector machines, random forests, K-nearest neighbor algorithms, neural networks, deep learning (LSTM), reinforcement learning, and ensemble learning. We will compare these models in terms of mean absolute error (MAE), mean squared error (MSE), training time, and model complexity.

**This chart is merely intended to illustrate the performance differences of various models in terms of price prediction. In practical applications, the choice of which model to use depends on predictive performance, computational resources, and actual requirements.

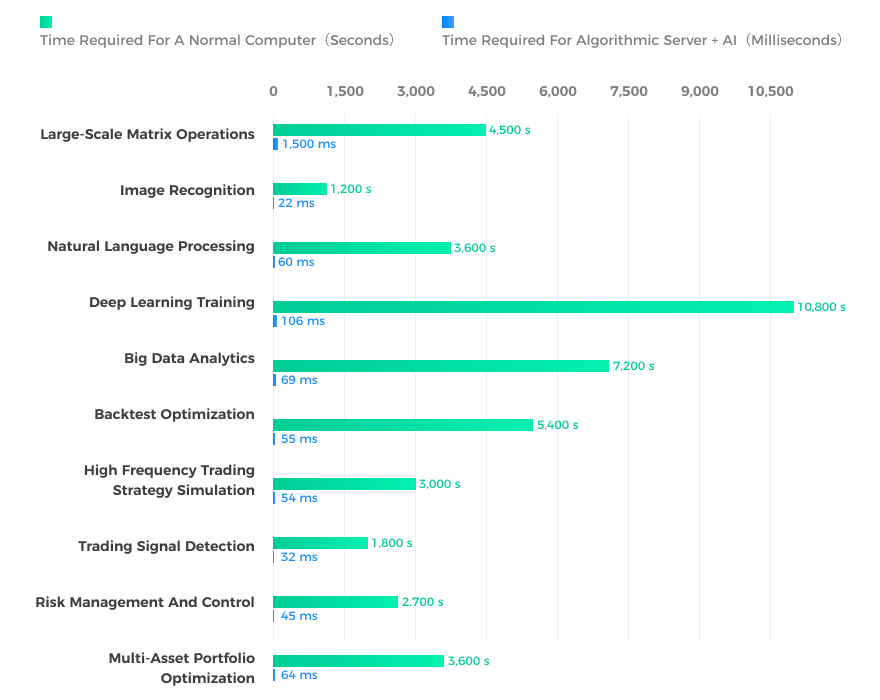

Algorithm server + artificial intelligence algorithm makes the arithmetic power greatly improved.

We compare the performance improvement of computational servers combined with artificial intelligence versus ordinary computers when handling quantitative trading-related tasks. Due to the more powerful computing capabilities of computational servers and the effective utilization of these resources through artificial intelligence technology, the time required to complete tasks is significantly reduced, resulting in a performance improvement of approximately 3,000 times.

**Please note that these data are for illustrative purposes only and actual performance gains may vary depending on factors such as task type, hardware configuration, and AI algorithms.

Validate the edge and prevent overfitting.

To validate the model's edge and prevent overfitting, we can use cross-validation methods. K-fold cross-validation is a commonly used validation method, the basic idea of which is to divide the training dataset into k subsets, using one of the subsets as the validation set and the remaining subsets as the training set each time. This process is repeated k times, with a different subset used as the validation set each time, and the average of the k validation results is calculated as the performance indicator of the model.

**From the table, it can be observed that as the number of validation iterations increases, the fluctuation in model performance tends to stabilize. In practical applications, more model parameters and different performance indicators can also be considered. It is important to note that this table is for illustrative purposes only, and actual performance data may vary depending on factors such as datasets, models, and parameter choices.

choose an investment plan

initial investment

expected return (annual)

$12500

**The expected return is calculated based on the average value of the strategy corresponding to the current investment amount, and the current calculated amount is not the actual return.

best plan for you

basic

subscription plan

Trust In The Media

page.index.connectedExchange

Coming soon

Coming soon

About Us

Our company, founded in 2021, leverages the power of collective intelligence and advanced machine learning models to deliver cutting-edge predictive analysis solutions. Our team of experts in mathematics, data science, quantitative trading, and finance collaborate seamlessly to provide businesses with insights that drive growth and success. With our unparalleled combination of technical expertise and innovative thinking, we are the preferred choice for organizations seeking to stay ahead of the curve in a rapidly evolving market.